audit vs tax big 4

Both supply such services to. Today we will be covering the pros and cons of working in audit or tax accounting at the big 4 accounting fir.

Audit Associate Resume Samples Qwikresume

Big four audit will pay less in the.

. I really like audit but dont mind tax. Both tax and audit are within a big four. I recently got an offer to become a Tax Associate with the Big 4 working specifically on financial instruments.

I work in tax. Some of the differences are outlined below. So Im wanting to know what the career path looks like for someone in Big 4 AdvisoryConsulting as opposed to TaxAudit.

Overview of Big 4 Audit Roles. Getting into the big 4 especially in audit can make for a very promising career. Feb 24 2012 The key difference between the two is that tax will likely lead to more tax roles.

Tax- figuring out ways for corporates to get out of their obligations multiplying profit by the tax rate. Both supply such services to companies. Audit is way better.

When I started my career Id have chosen Big four. Tax and Audit are both pretty good career tracks at the Big 4. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB.

Difficult question one only you can answer. Feb 24 2012 The key difference between the two is that tax will likely lead to more tax roles. The market isnt nearly as big for.

Depends entirely on your specialism. Big 4 Audit Vs. Advisory careers with a company like KPMG can.

One caveat is that many firms will not hire undergrads directly into their TASFAS groups. Answer 1 of 3. Alchemy-16 19 hr.

The Big Four are the four largest professional services networks in the world the global accounting networks Deloitte Ernst Young EY KPMG and PricewaterhouseCoopers. Tax is more specific to jurisdiction so you cant transfer across world. Im in corporate tax for a publicly-traded tech company but was previously in corporate tax for a large life insurer - pretty much every one of my colleagues Ive worked with.

However at this time. Which practice is better for you Audit or Tax. As a Tax Manager at one of the Big 4 Ive been happy with my dec.

Audit - Asking for loads of paperwork and data and messing around in excel for a. Are you interested in a career in accounting but dont know whether to choose Tax or Audit. Ago CPA US Big 4 Tax - F100 - F100.

Public accounting audit and tax can both be lumped together with regard to hours because it really just depends on the office and the clients you get staffed on. The key difference between the two is that tax will likely lead to more tax roles. Both tax and audit are within a big four.

I would say on average. Overview of Big 4 Audit Roles Big four audit will pay less in the beginning. If you need a specific branch just use MA for examples.

Audit is definitely more broad but that results in a wider range of potential exit opportunities as well. Overview of Big 4 Audit Roles Big four audit will pay less in the beginning. I picked tax because I didnt like my audit class in school because I had heard audit had the worst hours and.

Audit is a type of role which a person will see the world differently. Ziphoblat 4 hr.

Big Four Employee Numbers 2021 Statista

Kpmg Llp Audit Manager Resume Sample Resumehelp

Salary Breakdown Of The Big 4 Accounting Firms

What Are The Differences Between The Big 4 Preplounge Com

![]()

Salary Breakdown Of The Big 4 Accounting Firms

Deloitte Ey Kpmc And Pwc Everything You Need To Know About The Big Four Consultants

Companies See No Gain In Splitting Big 4 Tax And Audit Functions International Tax Review

Advantages Of The Big 4 Experience

Tax Accounting Resume Samples Velvet Jobs

Scoping Out The Audit Of The Future Accounting Today

Accounting Firms Top 10 Accounting Firms Across The Globe

Advantages Of The Big 4 Experience

Top Big 4 Companies Audit Companies 2022 Bizapprise

How I Chose Audit Vs Tax Kreischer Miller

Top Irs Audit Triggers Bloomberg Tax

Which Big 4 Firm Makes More From Consulting Than Audit And Tax Combined Going Concern

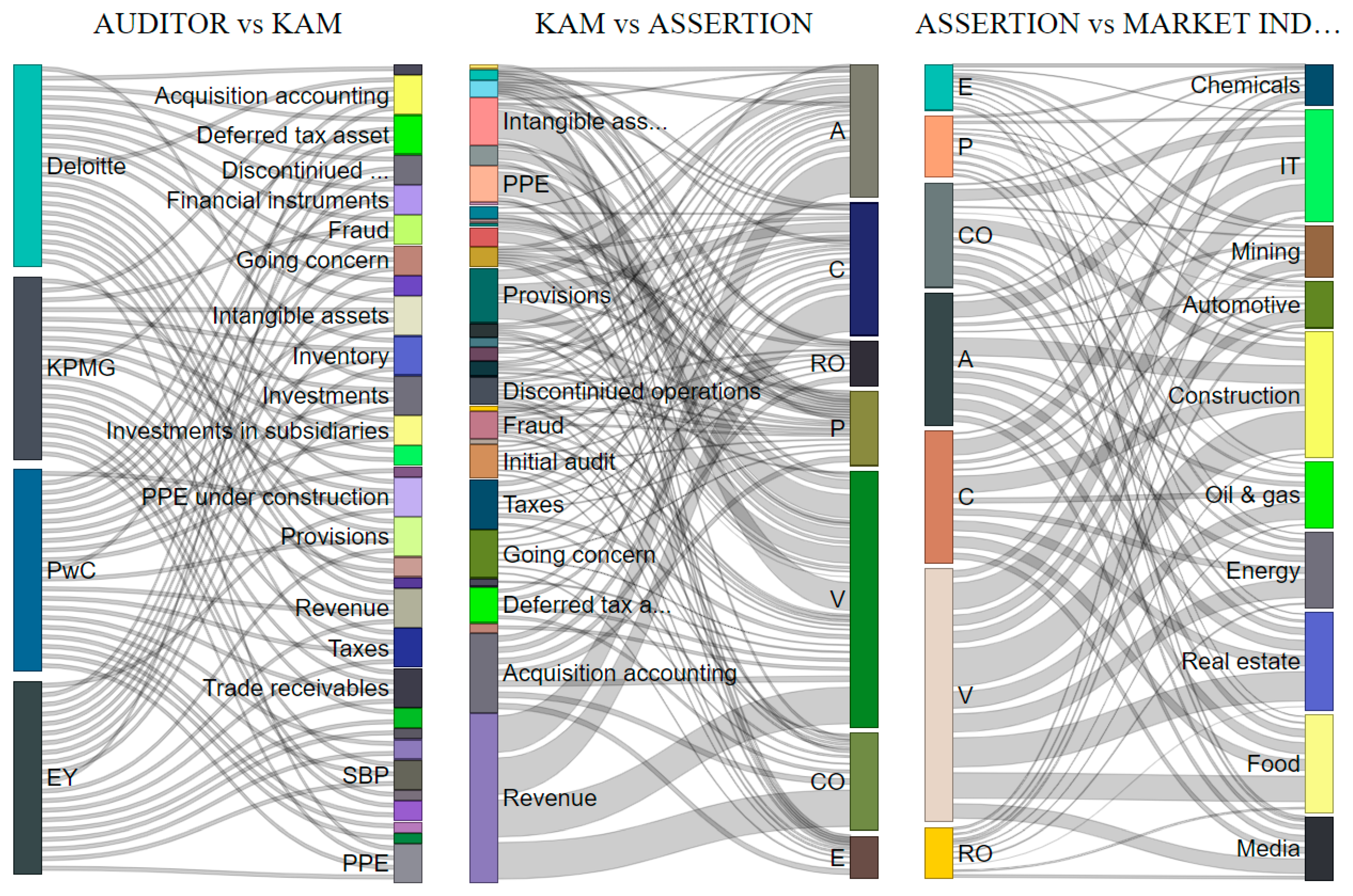

Jrfm Free Full Text Isa 701 And Materiality Disclosure As Methods To Minimize The Audit Expectation Gap Html

How Does The Hierarchy At The Big Four Pwc Ey Kpmg Deloitte In Their Consultancy Wings Compare To One Another In Terms Of Seniority Quora